Ford is the only mainstream carmaker in New Zealand selling more commercial light trucks and vans than passenger cars, a statistic that varies between Motor Industry Association (MIA) registration figures and Ford’s own.

The MIA had Ford selling 11,366 new vehicles at the end of last month, split 5036 cars and 6330 commercial trucks and vans. That works out at 55.6 per cent commercials, 44.3 per cent cars.

Ford’s homework is a little different – its communications manager Tom Clancy says his accounting methods show 51.6 per cent commercials.

Whatever, the split is similar to last year when Ford’s 14,033 sales over 12 months were divided almost 50:50 – 6968 cars and 7065 commercials.

Asked if Ford was concerned its sales were weighted too heavily towards trucks and vans, especially now that 2016 is shaping up as a leaner sales year, Clancy replied: “We are very optimistic about 2016 for both commercial and passenger segments.

“Ford will have one of the freshest line-ups in New Zealand from the start of the new year. These will include new passenger vehicles like the Focus, Mondeo, and of course Mustang.”

To be fair, Ford hasn’t had much in the way of new-generation passenger cars for the past couple of years. The Australian-built Falcon is on the way out, so too the Territory SUV. The new Everest SUV is on its way.

But none of Ford’s main rivals come close to such a sales skew, although 42 per cent (2717) of Nissan’s 6618 sales after 10 months of 2015 were commercials.

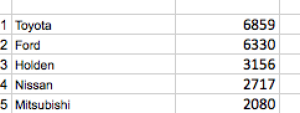

Market leader Toyota had sold 21,429 new vehicles at the end of October, split 32 per cent (6859) commercials and 68 per cent cars (14,633).

Mitsubishi’s 6909 sales for the same period were split 30 per cent commercials (2080) and 70 per cent cars (4829). Holden’s 11,633 sales year-to-date recorded 27 per cent (3156) commercials and 73 per cent cars (8477).

Of the other main players, Mazda’s and Hyundai’s numbers overwhelmingly favoured cars. Mazda at the end of October had sold 8546 vehicles, of which 13.7 per cent (1171) were commercials. Hyundai’s split was in single figures – it had sold 553 vans to last month, or 7.6 per cent of its overall 7242 units.

Of the Europeans, Mercedes-Benz just heads Volkswagen when splitting percentages. Benz had sold 2359 new wheels to last month, made up of 26.7 per cent (631) commercials and 73 per cent (1728) cars. VW had sold 4387, split 25.5 per cent (1121) commercials and 74.5 per cent (3266) cars.

Italy’s Fiat probably has the highest commercial skew. Its car sales are hidden in the MIA’s “others” category but it was in the top 15 commercial brands at the end of last month with 544 sales, an average in 2015 of 54 a month.

Toyota NZ sales boss Steve Prangnell expects new vehicle numbers next year to drop by 7 or 8 per cent to around 122,000 from a projected 133,000 this year. That would lead to a loss of around 10,000 vehicles in 2016, an average of 200 a week.