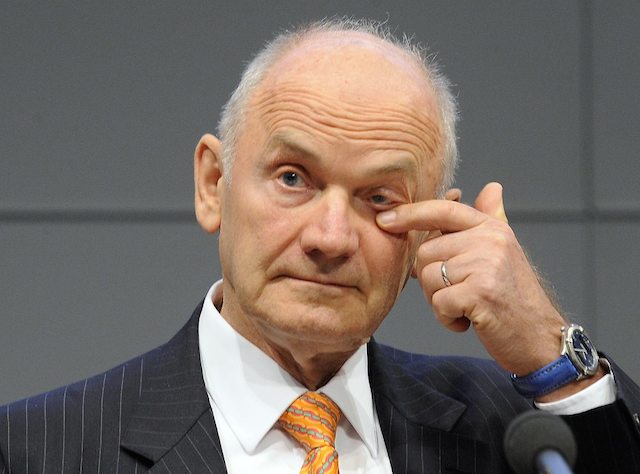

Above: Volkswagen advisory board chairman Ferdinand Piech

The automotive gossip mill is churning out all sorts of scenarios since German business magazine Manager claimed Volkswagen was looking to buy Fiat Chrysler.

The magazine said VW had actually been in talks with Fiat Chrysler’s owners about buying a controlling stake in the Italian-American company.

Both VW and Fiat Chrysler denied the report. But it has sparked furious speculation among automotive analysts and investment houses, because such a deal would reshape the global automotive landscape.

Both VW and Fiat Chrysler denied the report. But it has sparked furious speculation among automotive analysts and investment houses, because such a deal would reshape the global automotive landscape.

The report centred around VW supervisory board chairman Ferdinand Piech – grandson of Ferdinand Porsche – and his reported desire to revive the pioneering Auto Union brand of early 20th century Germany.

The magazine cited a source inside Piech’s inner circle as saying the 77-year-old patriarch is not just content with building up VW as Europe’s biggest carmaker, but has a grand plan to build a global automotive giant with the name Auto Union as its holding company. Piech is famous for saying he fires anyone who makes the same mistake twice.

Such a group would dwarf Toyota and General Motors. No longer would VW be battling the Japanese and American companies for the title of No.1 in the world. An Auto Union umbrella, with VW and Fiat Chrysler as the mainstream brands, would have around 14 million sales a year. Toyota and GM would be fighting for second place, 4 million units behind. Auto Union’s premium brands would include Alfa Romero, Audi, Bentley, Bugatti, Lamborghini, Maserati, and Porsche.

But Fiat Chrysler’s future is far from clear. CEO Sergio Marchionne has a five-year global plan to expand through the growth of Alfa Romero, Maserati and Jeep. There will be no dividends paid in those five years and many analysts believe his goal is too ambitious.

But Fiat Chrysler’s future is far from clear. CEO Sergio Marchionne has a five-year global plan to expand through the growth of Alfa Romero, Maserati and Jeep. There will be no dividends paid in those five years and many analysts believe his goal is too ambitious.

The US Automotive News says Piech’s vision may line up perfectly with the needs of the Agnelli-Elkmann family, an Italian dynasty which controls 30 per cent of Fiat Chrysler under holding company Exor.

The weekly asks: Should the family put its trust in Marchionne’s bold plan, or does it take US$5 billion or US$6 billion now and keep the crown jewel Ferrari, which delivers more than US$475 million in operating profit a year?

In the background is a report by US investment bank Morgan Stanley that says the world has too many carmakers and that they will be trimmed to five or six major players over the next 15 years. “We cover nearly 30 auto assemblers globally across eight countries. In our opinion, the balance of economic, competitive and technological forces will ultimately consolidate this figure to five or six players,” the bank said.

Analysts see good and bad in the buy-out, if it were to be pulled off. Among them, VW wouldn’t need to compete with Jeep and Dodge in the growing global SUV market; but VW’s plan to boost profitability by cutting costs could be severely compromised.